The best option strategy, if I think the underlying will not fall, would be

Vinay Bhandari

0 Comments

bank nifty analysis, bank nifty expiry day trading, bank nifty expiry strategy, bank nifty option chain, bank nifty option chain data in google sheet, bank nifty weekly expiry, butterfly, how we hedge future with option, how we learn hedging, how we learn option trading, iron condor, straddle, strangle

The Best Option Strategy

Option strategy that is best if I think the underlying will not fall would be

Expiry day Bank nifty option strategy

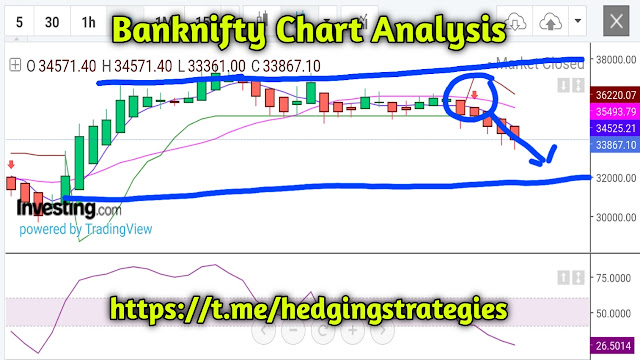

Bank nifty daily charts

” width=”640″ height=”360″ border=”0″ data-original-height=”720″ data-original-width=”1280″>

” width=”640″ height=”360″ border=”0″ data-original-height=”720″ data-original-width=”1280″>

For tomorrow expiry I think bank nifty will be in the range of 33000 to 33900. it will not fall below 33000 for tomorrow only. So which strategies is best for me?

First We Check Options Data

Bank nifty Automated Call Side Data

| SELL | SHORT BUILDUP | UP | DOWN | 17,375 | 7,775 | -807.05 | 966.15 | 32500 |

| SELL | SHORT BUILDUP | UP | DOWN | 3,525 | 2,800 | -772.5 | 895 | 32600 |

| SELL | SHORT BUILDUP | UP | DOWN | 3,175 | 1,850 | -785.7 | 797 | 32700 |

| SELL | SHORT BUILDUP | UP | DOWN | 8,100 | 3,000 | -774.6 | 708 | 32800 |

| SELL | SHORT BUILDUP | UP | DOWN | 17,975 | 12,950 | -762.4 | 622.8 | 32900 |

| SELL | SHORT BUILDUP | UP | DOWN | 136,825 | 77,650 | -746.4 | 550 | 33000 |

| SELL | SHORT BUILDUP | UP | DOWN | 19,100 | 15,100 | -735.1 | 476.95 | 33100 |

| SELL | SHORT BUILDUP | UP | DOWN | 27,300 | 18,575 | -714.6 | 405.15 | 33200 |

| SELL | SHORT BUILDUP | UP | DOWN | 122,375 | 104,700 | -697.75 | 343.25 | 33300 |

| SELL | SHORT BUILDUP | UP | DOWN | 144,850 | 111,925 | -672.75 | 287.1 | 33400 |

| SELL | SHORT BUILDUP | UP | DOWN | 758,000 | 413,575 | -646.75 | 230.45 | 33500 |

Bank nifty Automated Put Side Data

| 32500 | 52 | 16.05 | -89,825 | 647,350 | UP | DOWN | SHORT COVERING | BUY |

| 32600 | 59.95 | 19.25 | -2,650 | 129,475 | UP | DOWN | SHORT COVERING | BUY |

| 32700 | 71.15 | 24.65 | 47,325 | 207,650 | UP | UP | LONG BUILDUP | BUY |

| 32800 | 87.6 | 33.95 | 26,600 | 197,900 | UP | UP | LONG BUILDUP | BUY |

| 32900 | 107.4 | 46 | 2,450 | 135,575 | UP | UP | LONG BUILDUP | BUY |

| 33000 | 135 | 64.8 | -55,425 | 979,650 | UP | DOWN | SHORT COVERING | BUY |

| 33100 | 154.05 | 73.45 | -8,550 | 117,925 | UP | DOWN | SHORT COVERING | BUY |

| 33200 | 195 | 101.95 | -33,200 | 179,000 | UP | DOWN | SHORT COVERING | BUY |

| 33300 | 230 | 123.5 | -23,050 | 199,700 | UP | DOWN | SHORT COVERING | BUY |

| 33400 | 255.6 | 133.75 | -64,200 | 165,050 | UP | DOWN | SHORT COVERING | BUY |

| 33500 | 314 | 174.7 | -503,825 | 540,425 | UP | DOWN | SHORT COVERING | BUY |

Option strategy for Bank nifty expiry.

Buy 33000 Put @ 130

Short 32900 Put @ 105 (2 lots)

Payoff Chart For The Above Strategies

|

No

|

Strike

|

Premium

|

Option

|

Buy(1)Sell(0)

|

Expiry

|

Gross P/L

|

LOT SIZE

|

TOTAL P /L

|

| 1 | 33000 | 130 | put | 1 | 35000 | 80 | 25 | 2000 |

| 2 | 32900 | 105 | put | 0 | 34900 | 80 | 25 | 2000 |

| 3 | 32900 | 105 | put | 0 | 34800 | 80 | 25 | 2000 |

| 4 | 34700 | 80 | 25 | 2000 | ||||

| 5 | 34600 | 80 | 25 | 2000 | ||||

| 6 | 34500 | 80 | 25 | 2000 | ||||

| 7 | 34400 | 80 | 25 | 2000 | ||||

| 8 | 34300 | 80 | 25 | 2000 | ||||

| 9 | 34200 | 80 | 25 | 2000 | ||||

| pls whatsapp | 9699646408 | 34100 | 80 | 25 | 2000 | |||

| Difference | 100 | 34000 | 80 | 25 | 2000 | |||

| Expiry from | 35000 | 33900 | 80 | 25 | 2000 | |||

| lot size | 25 | 33800 | 80 | 25 | 2000 | |||

| 33700 | 80 | 25 | 2000 | |||||

| 33600 | 80 | 25 | 2000 | |||||

| 33500 | 80 | 25 | 2000 | |||||

| 33400 | 80 | 25 | 2000 | |||||

| 33300 | 80 | 25 | 2000 | |||||

| 33200 | 80 | 25 | 2000 | |||||

| 33100 | 80 | 25 | 2000 | |||||

| 33000 | 80 | 25 | 2000 | |||||

| 32900 | 180 | 25 | 4500 | |||||

| 32800 | 80 | 25 | 2000 | |||||

| 32700 | -20 | 25 | -500 | |||||

| 32600 | -120 | 25 | -3000 | |||||

| 32500 | -220 | 25 | -5500 | |||||

| 32400 | -320 | 25 | -8000 | |||||

| 32300 | -420 | 25 | -10500 | |||||

| 32200 | -520 | 25 | -13000 | |||||

| 32100 | -620 | 25 | -15500 | |||||

| 32000 | -720 | 25 | -18000 | |||||

| 31900 | -820 | 25 | -20500 | |||||

| 31800 | -920 | 25 | -23000 | |||||

| 31700 | -1020 | 25 | -25500 | |||||

| 31600 | -1120 | 25 | -28000 | |||||

| 31500 | -1220 | 25 | -30500 | |||||

| 31400 | -1320 | 25 | -33000 | |||||

| 31300 | -1420 | 25 | -35500 | |||||

| 31200 | -1520 | 25 | -38000 | |||||

| 31100 | -1620 | 25 | -40500 | |||||

| 31000 | -1720 | 25 | -43000 | |||||

| 30900 | -1820 | 25 | -45500 | |||||

| 30800 | -1920 | 25 | -48000 | |||||

| 30700 | -2020 | 25 | -50500 | |||||

| 30600 | -2120 | 25 | -53000 | |||||

| 30500 | -2220 | 25 | -55500 | |||||

| 30400 | -2320 | 25 | -58000 | |||||

| 30300 | -2420 | 25 | -60500 | |||||

| 30200 | -2520 | 25 | -63000 | |||||

| 30100 | -2620 | 25 | -65500 |

In the above chart it shows that

Maximum loss is unlimited.

loss start if bank nifty fall below 32700.

Profit if Bank nifty close above 32720.

Maximum profit RS 4500 at the level of 32900.

But I am expecting RS 2000 approx.

Please comment on the best option strategy

Other Articles

Disclaimer :

Blog Provides Views and Opinion as Educational Purpose Only, We are not responsible for any of your Profit / Loss with this blog Suggestions. The owner of this blog is not SEBI registered, consult your Financial Advisor before taking any Position.